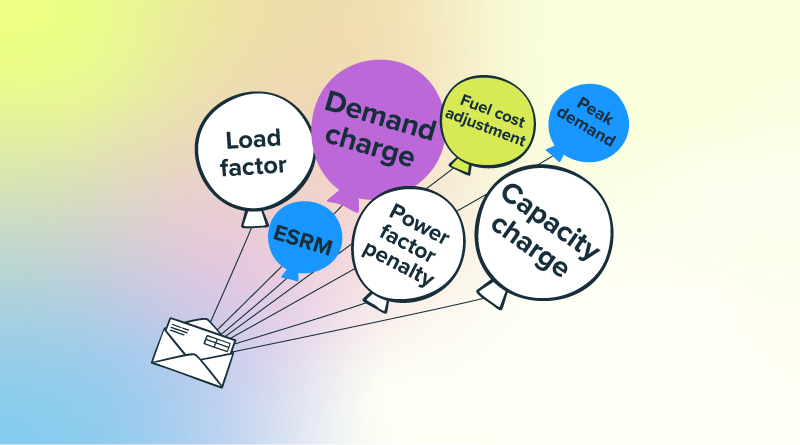

Paying utility bills is a task that falls to Accounts Payable (AP), but it’s also a critical link between finance, facilities, and store operations that you shouldn’t ignore. When payment workflows break down, late fees accrue, budget become inaccurate, and store reliability is at risk. Let’s explore what’s at stake, where chaos starts, and steps grocery chains can take to lower bills and bring order to the chaos.

Why grocery store utility bills can be so expensive

Most organizations are aware that late fees drive up their utility expenses. But late fees are usually a symptom of a larger problem: disorganized bill payment practices that create a ripple effect across your entire building portfolio. When you don’t have consistent bill review, analysis, and payment processes in place, your organization is open to:

- Budget drift: Late, missing, or mis-coded invoices distort accruals and month-end close. Variances look bigger than they are, which throws leaders off course.

- Forecast fog: Without a single source of truth for rates, usage, and approvals, forecasting loses credibility, especially with volatile energy prices and demand charges in play.

- Store risk: Payment gaps invite service threats and set off a finance and facilities scramble to correct shutoffs, salvage product, and battle reputational headaches.

Where chaos starts in grocery AP

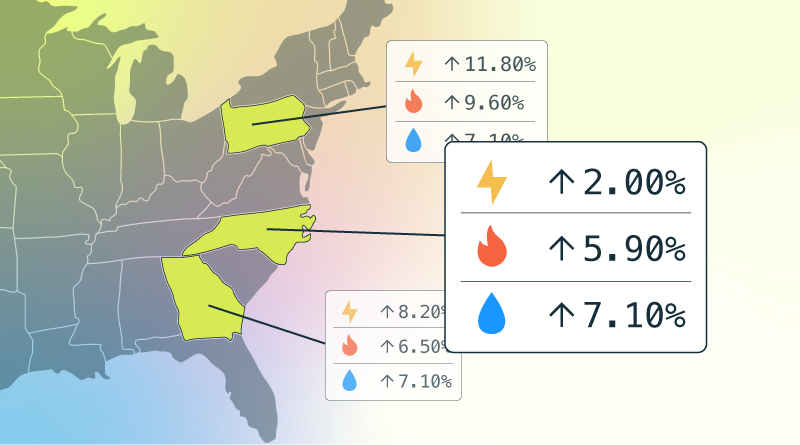

Grocery chains are uniquely complex: they have thousands of meters across electric, gas, water, waste, and telecom. They must also contend with franchise stores, ongoing remodels, rollouts, and seasonal peaks that push demand and bills skyward. Disconnected spreadsheets and portals make it easy to miss a bill, misroute an approval, or pay the wrong amount.

Common trouble spots:

- Fragmented intake: Paper, email, portals, and EDI feeds land in different queues.

- Manual entry: Re-keying invites costly errors and slows close.

- Siloed approvals: Facilities needs context, finance needs controls, and neither sees the full picture in time.

A modern utility payment operation does three things consistently: centralizes every bill and data point, validates bills before payments, and closes the loop amongst all parties. This ensures everyone is working from the same source of truth, that you’re paying the right amount to the correct vendors, and maintains accountability so bills don’t get lost.

Where grocery stores should start

Grocery stores might be gearing up for holiday season chaos, but the subsequent quiet winter months are the perfect time to implement utility bill payment processes. This can help prevent late fees and lower your utility bills in 2026.

- Create a single intake address for all utility invoices and route everything there. Scan paper bills on arrival and send them to the email you’ve created.

- Build a due-date calendar by vendor/site with reminders and assign clear task owners.

- Standardize vendor naming and account IDs so AP, facilities, and energy speak the same language.

- Run a monthly late-fee post-mortem to find the root cause, address any ongoing issues, and create an action plan.

- Complete quarterly vendor list cleanup by closing dormant accounts, updating contacts, and removing duplicates.

- Conduct an annual meter audit to confirm active meters by store and tariff and retire or correct strays.

- Consider a bill payment partner to take on intake, validation, and on-time remittance at scale.

Why bill pay integrated with energy management wins

Bill payment vendors can help get your invoices paid. But a utility-specific bill pay solution that lives inside your energy management platform ties payment to the data that explains the bill. A shared platform ensures your bills are audited for anomalies and errors, routed to the right people, and feeds forecasting and accruals from the same audited dataset.

All of this, before it also pays your bills. Stop paying late fees, close faster, and build a direct line from “what we paid” to “why we paid it.” Finance gains predictable cycles, facilities see what’s driving the bill, and operations stay focused on safety and comfort. With an integrated approach, organizations routinely eliminate late fees, reduce manual effort, and tighten forecast confidence.

Get utility bill payments under control with EneryCAP

Implementing best practices for grocery chains to pay their utility bills yields major benefits: centralize invoice intake, standardize approvals, enforce exception thresholds, and keep a tight missing-bill and late-fee playbook to lessen your chances of paying late fees or in-store shutoff disasters.

EnergyCAP Bill Pay with energy management software delivers the biggest gains: validated invoices, on-time payments, accurate accruals, and stronger forecasting for multi-site retailers. If rising energy prices and demand charges are pressuring margins, a bill payment partner integrated with your utility data reduces late fees, errors, and noise.

Get started today with a free EnergyCAP demo.